Funding and rating

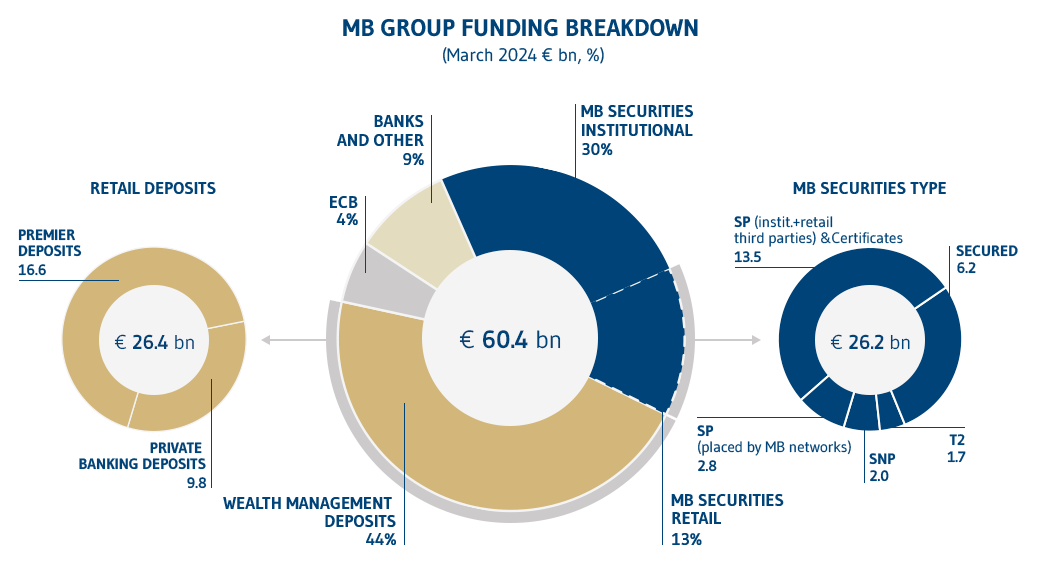

Our funding strategy has changed and diversified significantly over the years. Bond issues now account for less than half of our funding, compared with more than 60% in 2005, in 2008 we launched Mediobanca Premier to access retail deposits

Overall about 60% of our funding now comes from retail investors: 13% from our bonds sold to retail customers, while 44% of our funding is raised from Wealth Management deposit.

Our dedicated Products issued website contains all the details for our issues (prospectuses, types, maturities, recipients, etc.).

- Well diversified funding structure: 60% retail (13% bonds, 44% WM deposits) and 40% institutional (30% securities, 4% ECB, 9% banks and other)

- MB bonds totaling €26.2bn: €16bn senior preferred, €2bn SNP, €1.7bn T2, €6.2bn secured

- Wealth Management deposits at €26.4bn: €16.6bn Premier, €9.8bn Private Banking

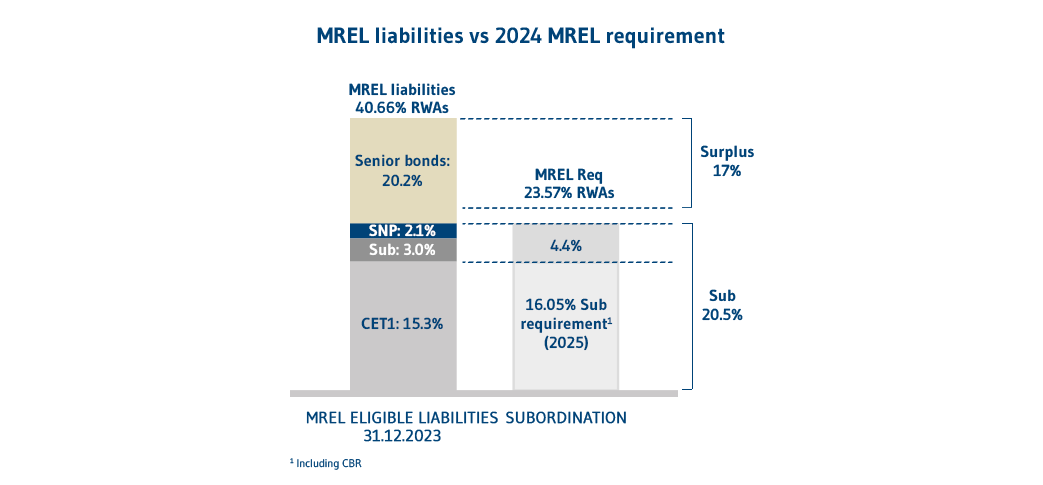

Substantial surplus MREL

(Highlights - results at December 2023)

- MREL requirement for 2023, among the lowest in EU, basically confirmed at:

- 23.57% RWA

- 5.91% LRE (Leverage Ratio Exposure)

- MREL own funds and eligible liabilities (~€20bn as of Dec23) @ 40.66% of RWAs with a surplus of ~17% of RWAs vs MREL requirement

- ~90% of MREL requirement covered by own funds and subordinated debt

Funding and liquidity indicators (at 30 JUNE 2023)

| LCR | NSFR |

|---|---|

| 180% | 119% |